However, it’s important to dig a little deeper to understand who third-party payment processors truly work for and when they are necessary. After all, they hear that sign-up is easy and they won’t have to pay any fees.

Many budding entrepreneurs, especially those who are just starting out, wonder whether a third-party payment processor is the right fit for them. Is Third-Party Payment Processing Necessary? Examples of well-known third-party payment processors include Square, PayPal, Stripe, and Stax.

The most suitable service will depend on your business needs. There are thousands of payment processing services in the U.S. The simplicity of not having to get an account with a bank to accept credit cards and conduct card transactions with a debit or credit card company can genuinely increase your business experience. What Are Some Examples of a Third-Party Payment Processor?Ī third-party payment processor is a merchant services provider that lets you provide more payment methods to your customers and helps you receive payments without first setting up your own merchant account with a bank. It helps to work with credit card processors and those who process payments online because it can increase the pool of buyers for any type of business. These payment processing companies can run debit cards, conduct credit card processing, and even serve as an online payment processor so you can expand your business to the digital realm. As a result, your customers’ payment information will be reviewed by the processor, along with running through a variety of anti-fraud measures, before they allow the completion of your client’s transaction. These companies allow customers like you to use their merchant account to process all of your debit card and credit card payments. Instead of having your own merchant account, which often comes with setup costs, you’ll instead work with a third party who has their own relationship with a merchant services provider, essentially serving as an intermediary.Ī well-known example of a third-party payment processing company is Square, which allows you to sign up and start accepting debit card payments on the very same business day.īy utilizing a third-party payment processor, you’ll be bypassing the step of having your own merchant account at a bank.

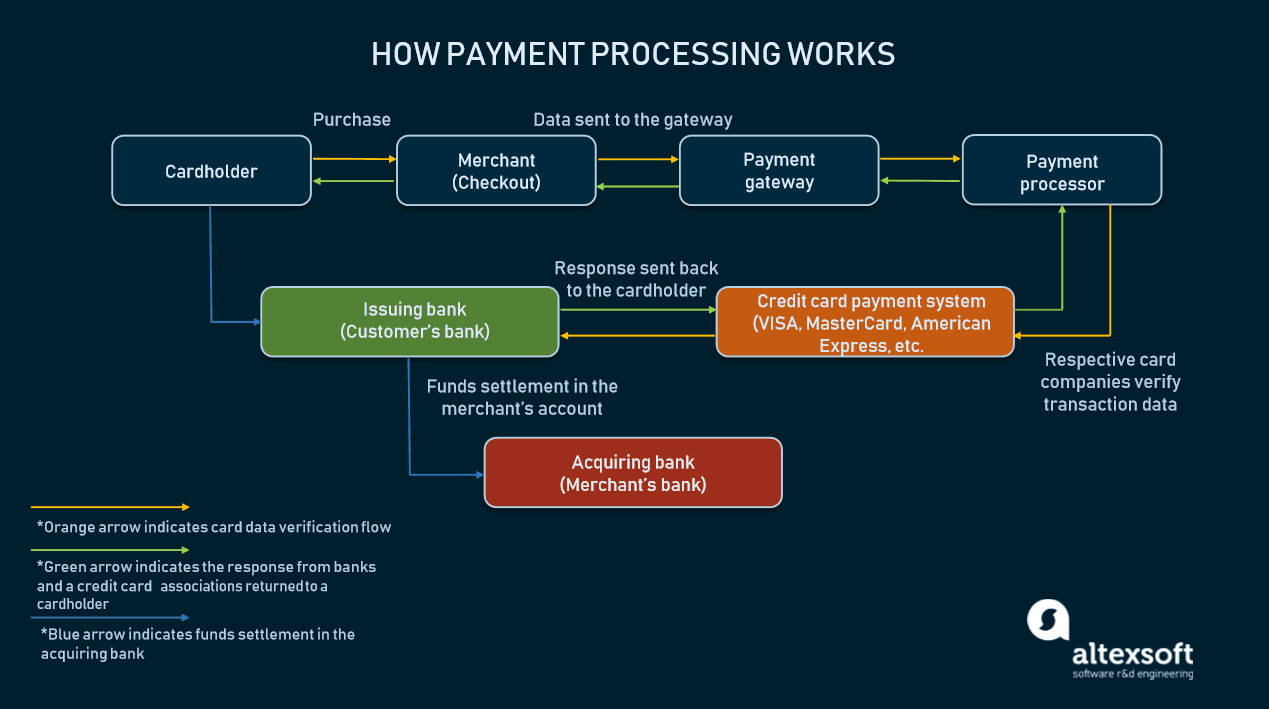

This is where a third-party payment processor comes into play. It takes time and effort to interface with merchant account providers, and if your business is still in its early start-up stage, your time can be better spent doing other things. However, for some businesses that are just starting out, this isn’t always the most economical method of taking payments. When their clients walk through the door and make a debit card purchase through a point-of-sale system, businesses with this type of account have the ability to accept payments directly through their own merchant account and be done. Many businesses have their own merchant accounts with merchant services providers. Learn More How Does Third-Party Payment Processing Work? You can simply create an account with a third-party payment processor, and have all your transactions go through them. That way, you won’t have to worry about setting up or maintaining a merchant account. Third-party payment processing business entities aim to make it as simple as possible for merchants to run their business, have simple payment flows, and conduct transactions. Third-party payment processors (sometimes referred to as payment aggregators) are entities that allow merchants to take online or credit card payments without the need to set up their own merchant accounts.

One of the best ways to simplify your revenue stream is to 0 Definition of Third-Party Payment Processingīefore you can truly decide if a third-party payment processing company is right for you, it helps to know exactly what they are. On the contrary, it can make life simpler for customers, merchants, and third-party participants in a transaction. This is the era of digitization and seamless payment processing, both offline and online.īut the digital evolution of payment processing doesn’t have to be difficult for a brick-and-mortar retailer or small business owner. Thanks to checks, credit cards, and debit accounts, gone are the days when cash was king. One of the many necessities that small and medium-sized businesses (SMBs) encounter is payment processing. Running a business comes with a whole set of tasks and potential difficulties even for the most successful companies.

0 kommentar(er)

0 kommentar(er)